So anyone have any idea what the UK Government will do next!?

I was at the AltFi summit last week and a theme in all the talks was you cannot predict what is going to happen next, you "need the ability to react quickly to survive". I had planned to write about how managing costs can support growth, now I will also touch on how you can make your company more resilient to deal with uncertainty/ who-knows-what-next.

1 Line Summary / TL;DR: Understanding what makes your company special is key to prioritising spending in a way that supports high-growth and builds resilience

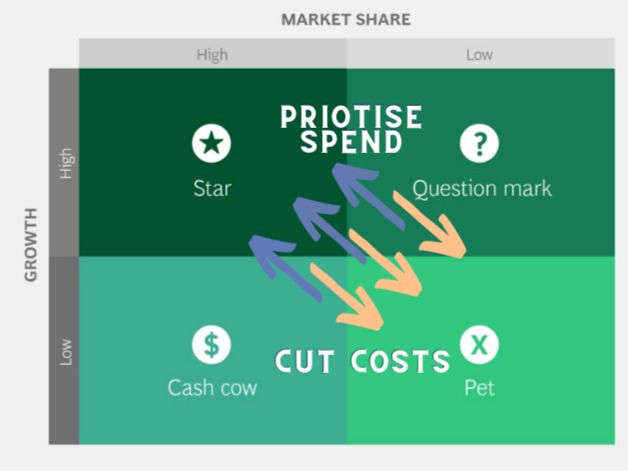

Over the COVID-19 era, I did a lot of cost-focused programmes, whilst the approach for large stable companies is not suitable for high-growth companies understanding the techniques allows us to adapt them to this environment. One key difference is a scale-up or high-growth company often hasn't made it yet, they are in the transition from "questions mark" to "star" (* BCG growth matrix) so just surviving a downturn isn't enough. They have the more challenging task of managing cashflows, raising investment and still positioning themselves for high growth in the future.

This reminded me of an episode of Abstract (**) which follows Ralph Gilles (Global Head of Design at Fiat Chrysler), so very different scenario. Having re-watched it today, they are many lessons we can take, the key being never to lose sight of the future.

2 Minute Summary

Lessons from a Car Designer

Skip to the next section below to go straight to common cost-reduction techniques and some practical tips on prioritising spending for high growth. But I think it is useful to consider the design & product angle first.

So you may be wondering why I am talking to you about a design show, how could this be relevant?

Ralph Gilles is Global Head of Design at Fiat Chrysler when the show is filmed, Chrysler has been through a failed merger with Mercedes, the 08 financial crash leading to a government bailout and then an acquisition by Fiat. He shows a very different perspective through all this as he is a car designer first and foremost and worked his way up through the company to the global leadership team.

The reason why this came back to me at this time is how he deals with the future, it's inherent uncertainty despite the company entering Chapter 11 bankruptcy in '09. He stays focused on the future, his vision and how he can help the company - the product and good design.

"You could feel the product being under-invested in and it absolutely almost cost us our livelihood and cost us the entire company"

"No matter how tough times are, you just do not compromise the product. You just don't"

Car design starts many years before you will see that model on a forecourt, it needs commitment and investment to ever be realised. That work now is a large part of if the car will be successful years later, the parallels with start-ups/ scale-ups/ new business ventures are clear.

I think it is important to make this point before we start to talk about cost as often companies are not crystal clear on what is the key to growth and competitive differentiation (it cannot be everything) or once cost becomes the focus it becomes all-consuming, the decisions are hard but you cannot lose sight of the future.

I wanted to finish talking about the human aspect, I have been through and led teams through redundancies and office closures, there is what is right for the business, and then there is how you lead your teams through it and do best by them.

Ralph comes across as a great leader, and the stats would say his team agree, 3% voluntarily took redundancy vs. 40-50% company-wide. He suggests it is their focus on a better successful future, I would add his passion and integrity. People follow people they trust and have confidence in. Now hopefully nothing as drastic will happen to your company, but in uncertainty, you need strong leaders and gossip is always pessimistic and fills a vacuum so you have to stay ahead.

There are wider lessons from the show, which I might come back to in a future blog. I particularly liked how he managed to critique leadership structures and the primacy of different capabilities.

"I became Head of Design .. they moved me under Engineering and that’s the kiss of death"

This is something we work with companies on and it needs to be carefully thought out rather than convenient. I would recommend this series if you haven't seen it, this episode was S1 E5.

Prioritising Spending for Growth - What are you betting on?

The current economic environment, wage growth, inflation, energy, currency and interest volatility and on and on. There is no doubt things are getting tough. It may be tempting to double down on growth, to grow your way out of the problem whether by volume, price or new products, as that has been your strategy till now and for some that will work (or get you to the next funding inflow). I know as an individual or leadership team you just cannot focus on everything, so many being the eternal optimists that you need for high growth, this will be your first instinct.

I would suggest a more nuanced approach, taking some time to step back and consider if this is the right approach for your entire company.... to start with, consider these questions:

What do you compete on?

What are your drivers of growth?

What are the 3-5 things (capabilities) you need to do better than anyone else?

For everything else you do, what do you need to do as well as others versus those you just need to do well enough (not badly just to the level you set yourself)?

If you can answer these try with your peers, I have never had a client where a leadership team was aligned on all of these before we started working with them.

Prioritising Spend or Cutting Costs?

On the classic BCG growth matrix (right), I have superimposed what can happen when you cut costs without a clear strategy as opposed to prioritising spending for growth. As in the car example above when times are hard, you still have to find ways to invest in growth This is supported by the research and most good advisors will encourage you to think in this strategic manner ***. We will come to the RJT approach to prioritising spending for growth and some practical tips.

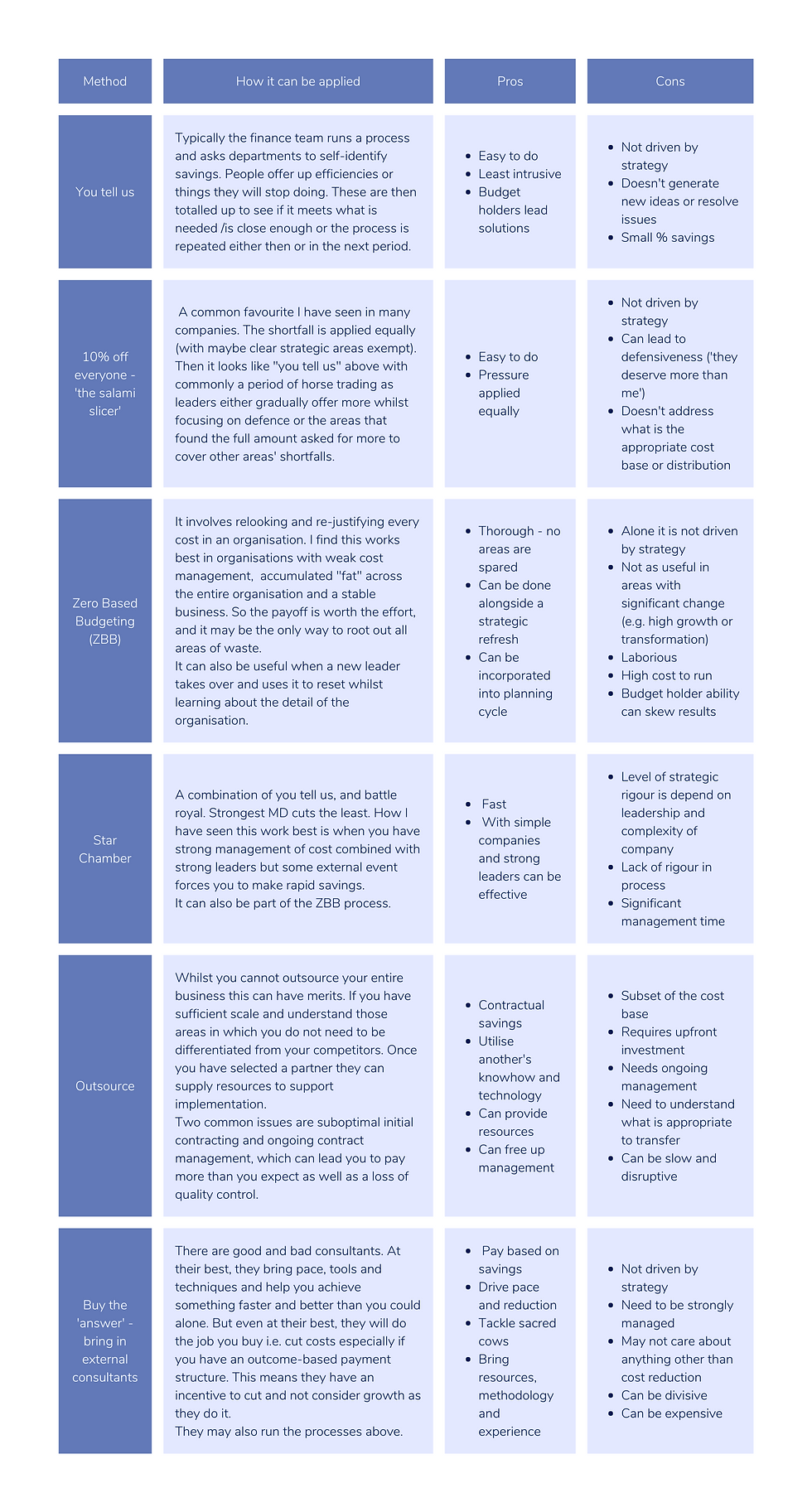

First I wanted to go through some of the common cost reduction methods, think about how your company would approach this and are they helping the company grow. I have experienced all of these in my time, on one side or the other so this is based on how I have seen these work in practice.

So How do you Prioritise Spend?

As alluded to above the first step is to understand your company, your strategy and how you will succeed before you employ any cost reduction measures. Typically at RJT we start by thinking about everything that you do, we use a 'Process Capability Framework' as the grounding for this but you may already have something else. Then we apply the 4 questions at the start to understand the relative important of your capabilities.

What do you compete on?

What are your drivers of growth?

What are the 3-5 things (capabilities) you need to do better than anyone else?

For everything else you do, what do you need to do as well as others versus those you just need to do well enough (not badly just to the level you set yourself)?

Once you have a clear understanding of this then you can apply different cost management techniques to each one. The aim in all is to be both effective and effective with your spend. But as we said up front you only have so much management bandwidth. So you probably want the managers performing good enough activity to be spending more time on cost management than the managers in differentiated. At RJT we have an approach centred around how you do this.

Some tips for whatever you decide to do:

As we have all heard "you have to spend money to make money" but as the wise head knows not all spend makes money. If you take only one thing away it is that understanding which spend will fuel your future growth.

Links referenced:

Comments